Contact us

Send us a message

To get in touch with us, fill out the form below and we will reach out to you as soon as possible.

Required fields are marked with a (*).

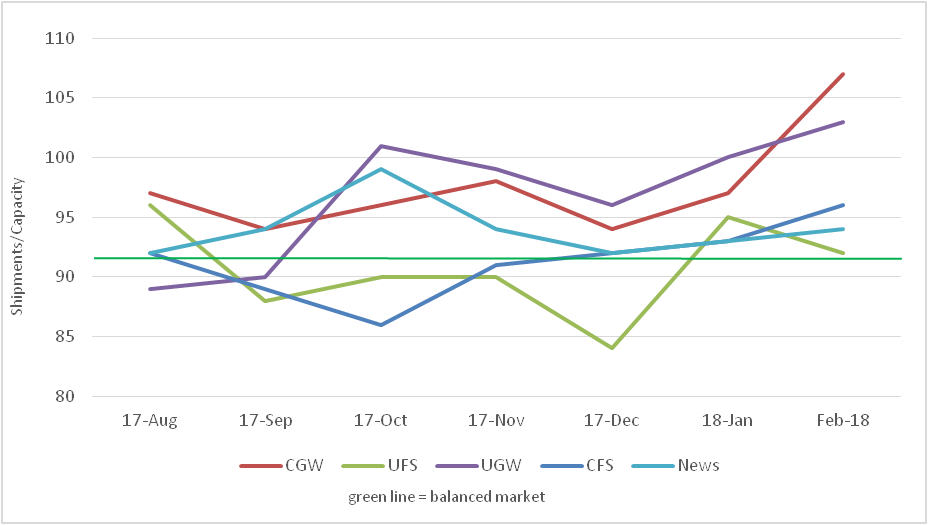

Mill Operating Rates (Shipments to Capacity - Seasonally Adjusted)

Mill Operating Rates (Shipments to Capacity - Seasonally Adjusted)  Product Segment Commentary Coated Freesheet - Lead times 5 – 8 weeks; operating rates continue to be very high, above recent historical Q2 averages - SAPPI conversion project at Skowhegan nearing completion; converted machine expected to restart on 4/23; will start back up making publication grades, packaging grades later - Verso, SAPPI and others have announced price increases on sheetfed grades for April through July of 4 – 5%. Coated Groundwood - Lead times 4 – 8 weeks; operating rates spiked in February, continue at much higher levels than in recent years Uncoated Freesheet - Lead times 4 – 6 weeks; impending capacity cuts keep market and pricing firm - Operating rates expected to rise as PCA/Boise converts a machine at Wallula, GP closes machine at Camas - Several mills announced price increases of 4% - 7% or $2.00 - $4.00/cwt depending on mill and product for various shipment dates in May - Lowering of tariffs on paper from Brazil could lead to more imports Uncoated Groundwood - High bright grades lead times 8 – 12 weeks; SC lead times 6 - 8 weeks; newsprint lead times 8 – 12 weeks - Mill reaction to anti-dumping duties (ADD) triggers price increases on newsprint and uncoated groundwood grades ranging from $2.00/cwt (those mills not subject to ADD) to as much as $6.25/cwt to take effect as soon as 3/26 out to 5/1 - NorPac part-time restart of PM1 to make high bright groundwood grades and corrugating medium adds some capacity to a very tight market - Catalyst discontinues heavyweight directory in 22.1# bs wt - SC suppliers have all announced a $2.00/cwt price increase for either 5/1/18 or 6/1/28

Product Segment Commentary Coated Freesheet - Lead times 5 – 8 weeks; operating rates continue to be very high, above recent historical Q2 averages - SAPPI conversion project at Skowhegan nearing completion; converted machine expected to restart on 4/23; will start back up making publication grades, packaging grades later - Verso, SAPPI and others have announced price increases on sheetfed grades for April through July of 4 – 5%. Coated Groundwood - Lead times 4 – 8 weeks; operating rates spiked in February, continue at much higher levels than in recent years Uncoated Freesheet - Lead times 4 – 6 weeks; impending capacity cuts keep market and pricing firm - Operating rates expected to rise as PCA/Boise converts a machine at Wallula, GP closes machine at Camas - Several mills announced price increases of 4% - 7% or $2.00 - $4.00/cwt depending on mill and product for various shipment dates in May - Lowering of tariffs on paper from Brazil could lead to more imports Uncoated Groundwood - High bright grades lead times 8 – 12 weeks; SC lead times 6 - 8 weeks; newsprint lead times 8 – 12 weeks - Mill reaction to anti-dumping duties (ADD) triggers price increases on newsprint and uncoated groundwood grades ranging from $2.00/cwt (those mills not subject to ADD) to as much as $6.25/cwt to take effect as soon as 3/26 out to 5/1 - NorPac part-time restart of PM1 to make high bright groundwood grades and corrugating medium adds some capacity to a very tight market - Catalyst discontinues heavyweight directory in 22.1# bs wt - SC suppliers have all announced a $2.00/cwt price increase for either 5/1/18 or 6/1/28