December 2017 Paper Market Update

December 18 , 2017

LSC Communications Monthly Paper Market Update December 2017

Industry News

World Trade Organization Upholds Existing Antidumping and Countervailing Duties Against Imports of Certain Coated Paper from Indonesia

- Duties (38% total) originally imposed on Oct. 2010 will remain in effect; applies to coated paper in sheet form

- http://investor.versoco.com/2017-12-07-WTO-Panel-Upholds-the-Imposition-of-Antidumping-and-Countervailing-Duties-on-Imports-of-Certain-Coated-Paper-from-Indonesia

SAPPI Invests in Paper Machine at Cloquet, MN mill

- $5.94MM investment to rebuild headbox on PM 12

- Dilution profiled headbox will improve product quality on graphic papers and packaging products

- https://www.sappi.com/sappi-north-america-invests-594-million-cloquet-minn-mill

Appleton Coated Restarts on Limited Basis

- Recently idled mill starts up one of three paper machines

- Production limited to brown medium and inkjet book only

- http://www.wbay.com/content/news/Appleton-Coated-restarting-machine-calling-back-50-workers-462374913.html

Norske Scog Enters into Structured Auction Process

- Largest creditor forces action as best path forward

- 7 paper mills will continue to operate as new ownership is sought

- https://www.reuters.com/article/norske-skogsind-ma-aker/update-2-end-of-road-looms-for-norske-skog-as-aker-seeks-to-buy-paper-mills-idUSL8N1NT1F3

Forest Stewardship Council Publishes Revised Trademark Standard

- Revised standard specifies requirements for use of FSC trademarks, for promotion of FSC certified products and for promotion of organization’s status as an FSC certificate holder

- New standard effective 3/1/2018

- https://us.fsc.org/en-us/newsroom/newsletter/id/1010

Uncoated Freesheet and Groundwood Focus

- Capacity reductions on uncoated freesheet as a result of closure of West Linn and Appleton Coated plus announced paper machine closure by Georgia Pacific and conversion by PCA both in Q1 2018 will have removed approximately 8% of North American uncoated freesheet capacity.

- Trade case against Canadian producers of newsprint and high bright groundwood grades could result in price increases and possibly even capacity reductions as a result of duties placed on paper coming to US.

- Both circumstances combined could result in longer lead times and/or higher prices for both product segments (SC papers excluded). Grade substitution could be possible and add to lead times to one product segment or the other.

- A new round of price increases in early stages in both segments have been announced since December 1 (Verso, Twin Rivers, Resolute).

- Forecasting and early planning of print projects key to reduce impact.

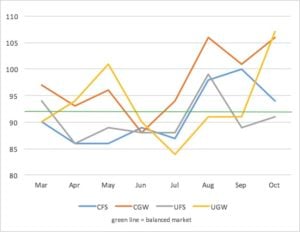

Mill Operating Rates (shipments to capacity - not seasonally adjusted)

Product Segment Commentary

Coated Freesheet

- Lead times 6 – 10 weeks; Q4 operating rates in high 90’s due to seasonal demand and loss of West Linn, Appleton Coated

- Near to mid-term forecast is for mills to operate at or close to full capacity which will make it hard to replenish inventory

- SAPPI conversion project at Skowhegan mill will remove 30 days of production from 1 of 3 paper machines in Q1 2018

- 2 nd $2.00/cwt price increase of 2017 announced for November 1 will be fully implemented by January 1.

Coated Groundwood

- Lead times 4 – 8 weeks; Q4 operating rates in high 90’s to over 100 due to seasonal demand and July capacity loss

- $1.00/cwt increase announced for October 1 will be fully implemented by January 1

- UPM PM5 closure at end of Q1 2018 will keep remaining capacity busier in H1 2018 than historical averages

Uncoated Freesheet

- Lead times 3 – 6 weeks; operating rates near 90%

- Outlook for Q1 2018 is that capacity reductions could result in longer lead times and possible price increases

- Decreased supply to West Coast coming in 2018 could require longer lead times and/or freight considerations

Uncoated Groundwood

- High bright ground grades lead times 6 – 10 weeks; newsprint lead times 6 – 8 weeks; SC lead times 4 – 6 weeks

- High brights impacted by earlier capacity reductions; NorPac trade case rulings expected 1/8/18 and 1/16/18, could result in significant duties against Canadian producers

- Newsprint capacity closures resulting in high operating rates and higher prices for near to mid-term

- Demand for SC grades falls off after holiday advertising season.

Send us a message

To get in touch with us, fill out the form below and we will reach out to you as soon as possible.

Required fields are marked with a (*).