February Paper Market Update

February 28 , 2018

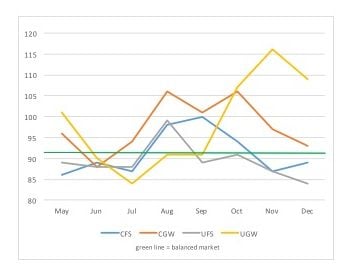

LSC Communications February 2018 Paper Market Update Glatfelter Considers Potential Sale of Specialty Papers Unit - Challenging market conditions, lower profitability cited as reasons for strategic review; no target date set for decision - Several grades, including those for book publishing, could be impacted; products are produced at Spring Grove, PA, Chillicothe and Fremont, OH facilities Potential Future Plans for Verso’s Duluth SC Mill Discussed - Single machine, supercalendered paper mill long thought to be considering options for future as demand for SC paper declines - Potential investment could expand product offering to compliment SC publication papers Stora Enso Reports Strong Quarterly Results, Considers Future of Paper Business Including Potential Sale - Stora’s European paper mills produce range of products from newsprint to coated freesheet Verso Announces $17MM Investment to Restart Androscoggin PM3 to Make Packaging Grades - Machine, idled since January 2017, will restart by end of 2018 Resolute Forest Products Announces New CEO - Richard Garneau to retire; succeeded by Yves Laflamme European Paper Market: Rising Prices, Long Lead Times Much like the current state of the North American publication paper market, paper buyers in Europe are seeing price increases and longer lead times for paper. In 2017 and early 2018 significant capacity closures, especially in supercalendered papers, swung the supply/demand balance to support price increases and extended lead times. Reduced SC capacity has caused some users to switch grades due to availability. As a result, European mills are forecasted to be full in 2018 in many market segments, and some are having difficulty accepting new business opportunities due to availability. As far as impact on the US market, a small sampling of industry data suggests that in Q4 2017 less publication paper came to the US than in 2016. In particular, in November ’17 imports of European coated freesheet and uncoated groundwood were down more than 40% compared to November ‘16. The appreciating Euro relative to the US Dollar has also influenced how much paper European mills are inclined to sell here. European mills have asked US customers for full-year forecasts to protect their needs. Much like with US mills, forecasting and planning are key to ensuring timely delivery. Mill Operating Rates (Shipments to capacity- not seasonally adjusted)

Product Segment Commentary

- Coated Freesheet - Lead times 6 – 10 weeks; near to mid-term forecast is for mills to operate at or close to full capacity - Production of uncoated freesheet has been curtailed to handle demand for coated freesheet - Price increases of $2.00/cwt announced for 3/1 - SAPPI conversion project at Skowhegan will commence late March; will remove 30+ days of production from 1 of 3 paper machines; once complete paper machine production will flex between publication grades and packaging

- Coated Groundwood - Lead times 4 – 8 weeks; operating rates for this time of year higher than in recent years - Price increases of $2.00/cwt announced for 3/1 - Early closure of UPM PM5 at end of 2017 will keep remaining capacity busier in H1 2018

- Uncoated Freesheet - Lead times 3 – 6 weeks; impending capacity cuts keep market and pricing firm - Price increases of $2.00 - $2.50/cwt from 1/1 to 3/1 implemented or in process of being implemented - Domtar mulling machine conversion later in 2018 - Decreased supply to West Coast coming in 2018 could require longer lead times and/or freight considerations

- Uncoated Groundwood - High bright groundwood grades lead times remain 8 – 12 weeks; newsprint lead times remain 8 – 12 weeks; SC lead times 6 – 8 weeks - A new round of price increases announced in all product segments for 3/1 due to supply/demand balance and impact of duties against Canadian producers of news, high brights and directory; ruling on anti-dumping duties due early March - White Birch announces exit from directory paper - SC producers have announced a $2.00/cwt increase for 3/1

Send us a message

To get in touch with us, fill out the form below and we will reach out to you as soon as possible.

Required fields are marked with a (*).