IP Completes Spin-off of Printing Papers Business

International Paper Company completed the previously announced separation and spin-off of its global printing papers business, now operating as Sylvamo Corporation and trading on the NYSE under the ticker symbol SLVM. Sylvamo employs more than 7,000 people in Europe, Latin America and North America. Net sales for the last 12 months ending June 30, 2021, were $3.2 billion.

RISI Sees Higher Paper Pricing Ahead

Most of RISI’s paper pricing forecasts have shifted to the high side, driven by recent supply-side developments and RISI’s increasing conviction that the ongoing demand recovery has become limited primarily by low paper availability rather than the erratic progress of economic reopening and recovery. This results in a greater potential recovery for paper demand, but long lead times at mills and depleted inventories will push some of this demand into 2022. As a result, RISI expects very high operating rates to continue for most printing & writing grades. (RISI)

Further Uncoated Freesheet Price Increases Announced

Domtar announced 6-9% price increases for all its UFS grades in the U.S. and in Canada, including office, printing, publishing, converting, and specialty paper products, effective Nov. 1. Earlier this month, Pixelle and Rolland announced 6-8% price increases on all UFS grades in the U.S. and in Canada, effective Oct. 18 and November 1 respectively. Other smaller North American UFS suppliers including French Paper, Norpac, Willamede Falls Paper, Twin Rivers, Evergreen Packaging, Neenah, and Phoenix Paper as well as overseas suppliers including The Navigator Company, Suzano, and Mondi announced 6-9% price increases on UFS paper for September, October, or November. Although PCA and IP have yet to announce new UFS price increases, these announcements represent a third industry-wide price increase for UFS paper grades in North America in 2021, following the March-April and June-July increases, each of about 6-9% depending on the grade and supplier. Paper prices continue to rise due to production capacity closures, supply chain issues, and increasing input costs.

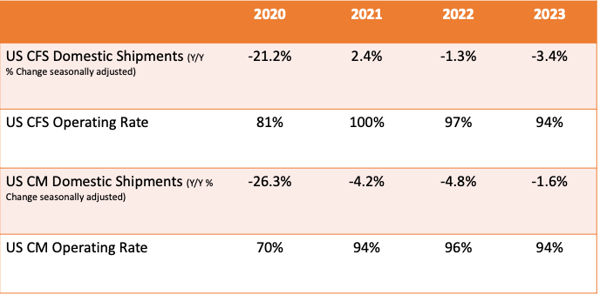

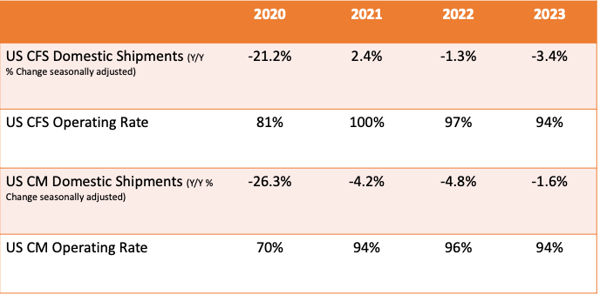

Demand and Operating Rate Forecasts (RISI)

U.S. Economy and Paper End-Use Indicators

N.A. Coated Paper Operating Rates

\

\

N.A. P&W Paper Producer Inventories

\

\